Inherited ira rmd calculator vanguard

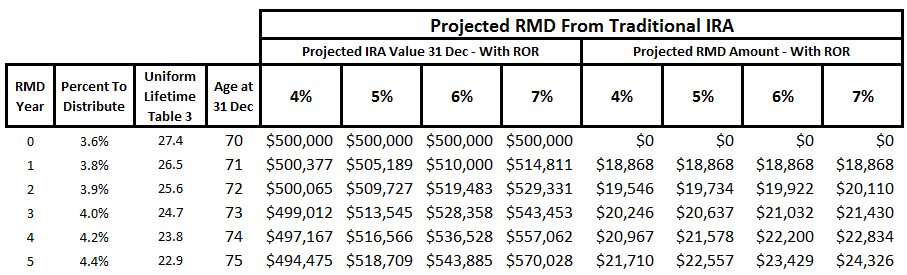

Generally your required minimum distribution RMD for a given year must be withdrawn by December 31 of that year either in a lump sum or in installments. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

You can find it in.

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

. You must follow RMD rules when you inherit retirement accounts as well. For example although Roth IRAs dont have RMDs for the original account owner you must take an. Once you reach RMD age well automatically calculate your annual distribution.

Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Use oldest age of. Calculate the required minimum distribution from an inherited IRA.

Cyberpunk 2077 skill calculator. You can also explore your IRA beneficiary withdrawal options based. If you inherited an IRA from your spouse you have the choice of either moving the money into your own IRA or into an inherited IRA.

You can print the results for future reference. Compare Investments and Savings Accounts INVESTMENTS. How is my RMD calculated.

Determine the required distributions from an inherited IRA. This calculator has been updated to reflect the new. Under the 10-year rule the value of the inherited IRA needs to be zero by Dec.

The amount of your RMD is usually determined by the fair market value. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. 31 on the 10th anniversary of the owners.

However if youre taking an. You can use the Traditional IRA calculator if youve inherited an IRA from a spouse. Ad Learn More about How Annuities Work from Fidelity.

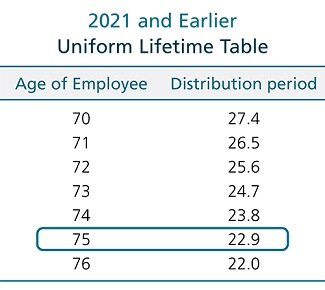

This calculator assumes the assets have been transferred from the original retirement account to an inherited IRA in the name of the beneficiary. The IRS uses three life expectancy tables for various RMD situations but the one that applies to inherited IRAs is called Table I Single Life Expectancy. Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans.

What happened to mac on wmuz. The SECURE act changed the RMDs for inherited IRAs. If youve inherited an IRA andor other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required Minimum.

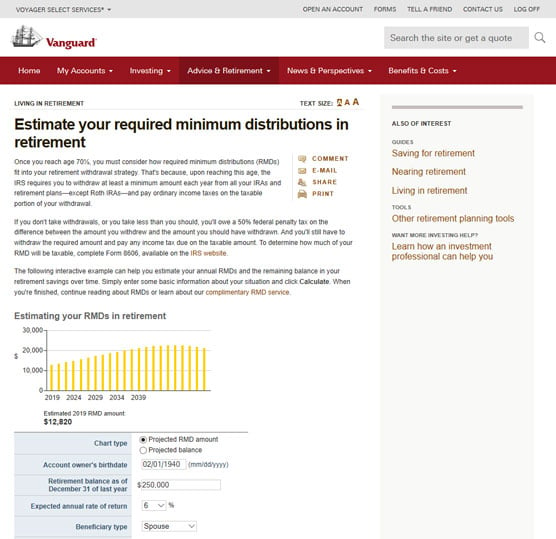

Resources for Small Business Entrepreneurs in 2022. This calculator uses the latest IRS life. If youre RMD age Vanguard will automatically calculate the RMD amount each year for your tax-deferred IRAs and Individual 401ks held at Vanguard.

Determine beneficiarys age at year-end following year of owners death. Ad Learn More about How Annuities Work from Fidelity. Receive small business resources and advice about entrepreneurial info home based business business.

The RMD rules are different for each choice so consider. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. Once enrolled you can view your RMD.

89. Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account. The IRS has published new Life Expectancy figures effective 112022.

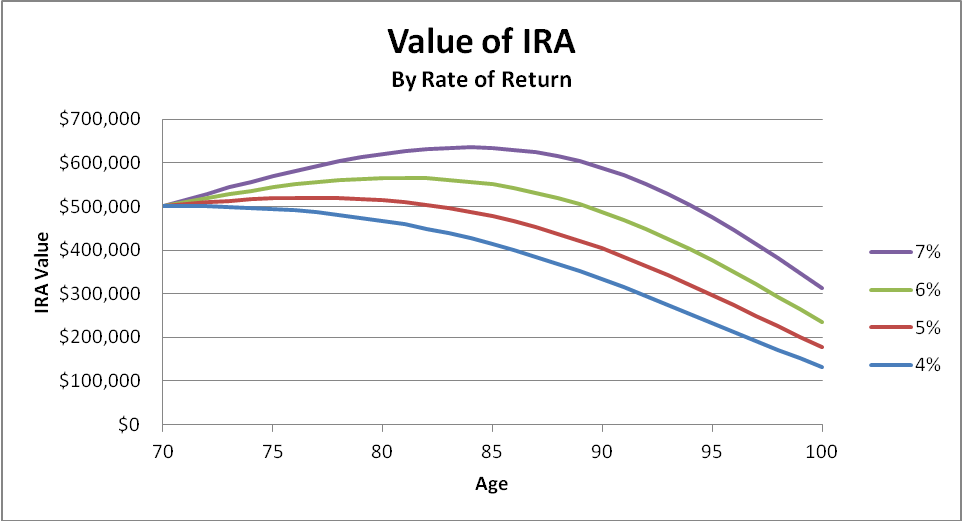

Does Vanguard offer a service that can help with my RMD calculations and distributions. Required minimum distributions RMDs Under federal tax law most owners of IRAs except Roth IRAs must withdraw part of their tax-deferred savings each year starting at age 72 age 70½ if. Understand What is RMD and Why You Should Care About It.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Retirement Cash Flow From Ira Rmds Seeking Alpha

Inherited Ira Rmd Calculator Td Ameritrade

Required Minimum Distributions Rmds Youtube

How To Take Money Out Of Your Ira Dummies

Inherited Ira Rmd Calculator Powered By Ss Amp C

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Vanguard Rmd Calculator Fill Online Printable Fillable Blank Pdffiller

Where Are Those New Rmd Tables For 2022

Can You Wait Until April 1 2022 To Take Rmd From Ira Inherited In 2021

Irs Wants To Change The Inherited Ira Distribution Rules

Retirement Cash Flow From Ira Rmds Seeking Alpha

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

The New Year Will Bring New Life Expectancy Tables Ascensus

Inherited Iras Rmd Rules For Ira Beneficiaries Vanguard